november child tax credit payment schedule

To reconcile advance payments on your 2021 return. The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36 million families it believed to be eligible to receive them.

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Payments will be made on the same date in November and December before the other half of the child tax credits will be distributed in April 2022.

. However for some families the monthly. 600 in December 2020January 2021. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022.

Enter your information on. Up to 300 dollars. November child tax credit payments are expected to be issued in the coming weeks.

The percentage depends on your income. Get your advance payments total and number of qualifying children in your online account. The complete 2021 child tax.

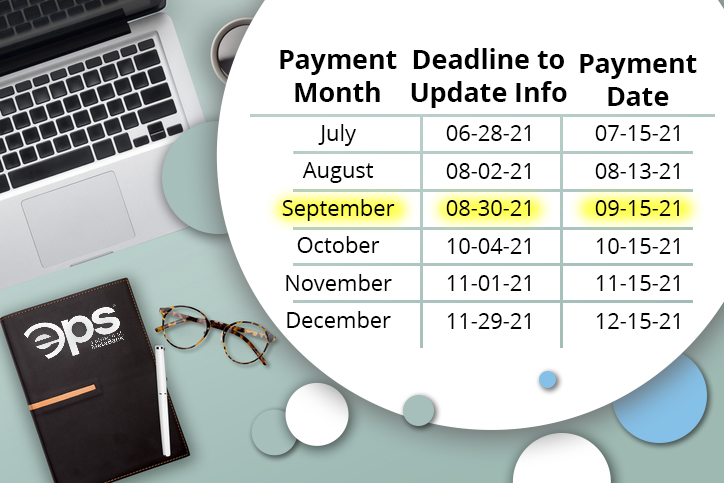

This has been changed to 75000. With the November payments still on their way to some families this is an updated list of the 2021 Child Tax Credit advance payments schedule. 1 Child tax credit.

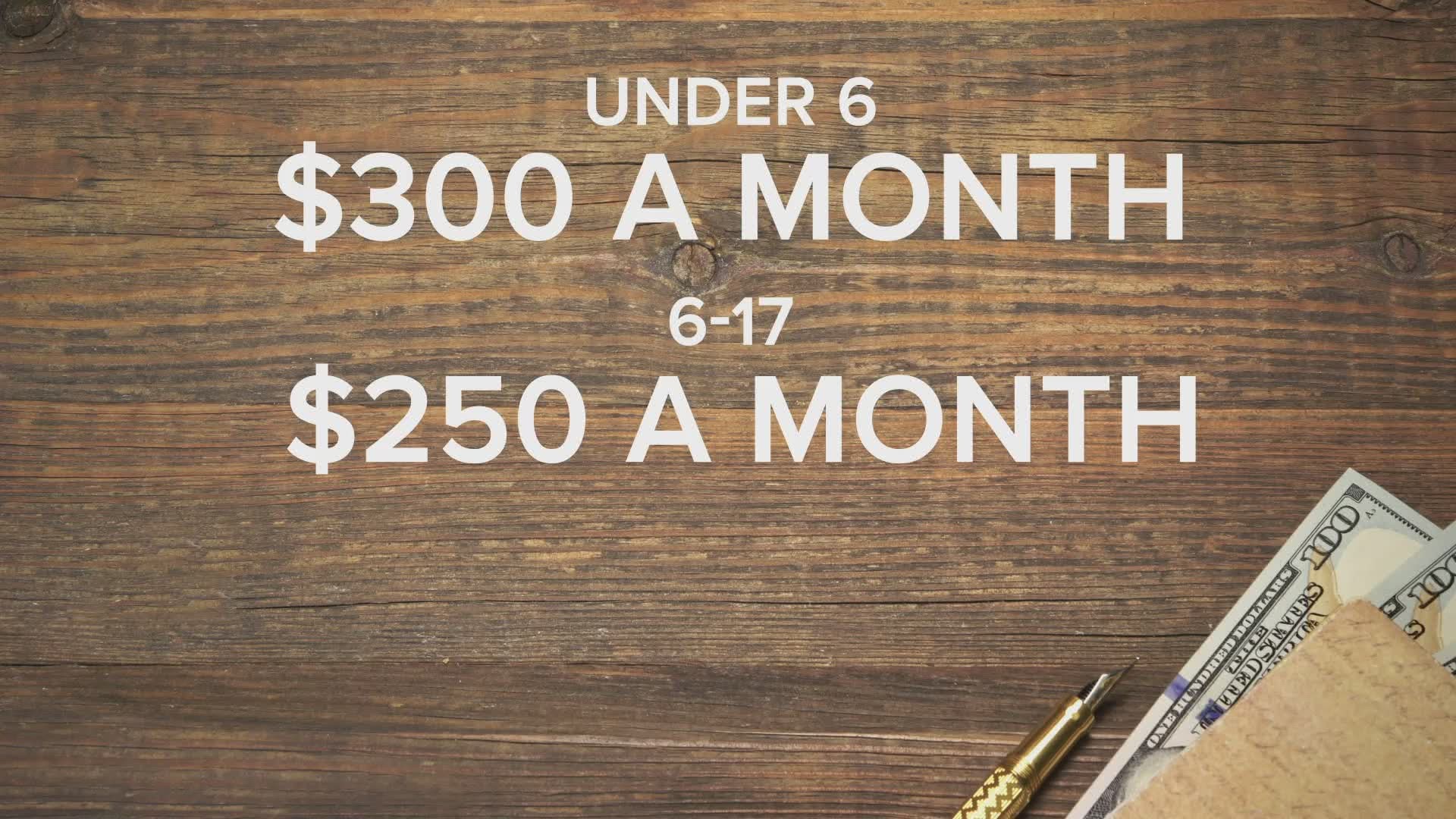

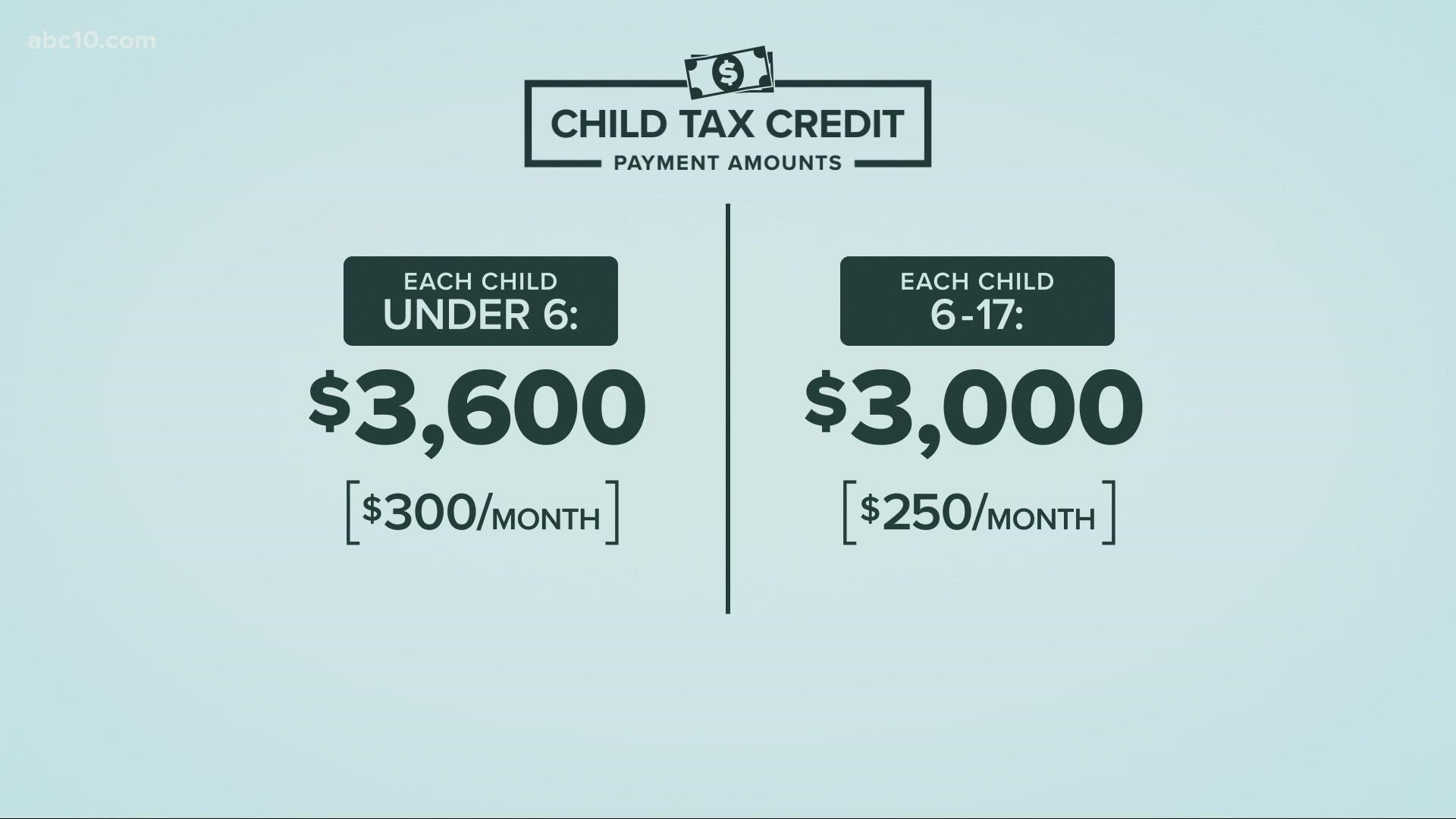

Prior to upping the child tax credit to 3000 and 3600 the income limits were around 200000 for most taxpayers. Individual Income Tax Return and attaching a completed Schedule 8812. Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

The payments go out on the 15th of each month except on weekends so the November payment will come Monday. Alberta child and family benefit ACFB All payment dates February 25 2022 May 27 2022 August 26 2022 November 25 2022 Havent received your payment. November child tax credit payment schedule Monday July 11 2022 Edit.

2022 You will not receive a monthly payment if your total benefit amount for the year is less than 240. The bill was enacted in March to help families get back on their feet amidst the Covid. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to.

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US. The rest will come at tax time next year. The refundable portions of the Earned Income Tax Credit and Child Tax Credit help low- and moderate-income working families by offering cash payments to eligible.

The next batch of child tax credit payments is scheduled for December 15. Changes to income limits. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. That will be the sixth and final monthly payment this year. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

The CRA makes Canada child benefit CCB payments on the following dates. For each qualifying child age 5 and younger up to 1800 half the total. 1200 in April 2020.

The payment for the.

Where Is My Child Tax Credit Netspend

Child Tax Credit Payment Schedule Here S When To Expect Checks King5 Com

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

2021 Child Tax Credit Advanced Payment Option Tas

When Is My November Child Tax Credit Coming Irs Payments Wbir Com

4 News Now Q A What Should Parents Know About The New Child Tax Credit Kxly

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

Deadline To Claim Child Tax Credit Up To 1 800 Per Child Coming Up Nov 15 Dollars And Sense Abc10 Com

Child Tax Credit 2021 Update November Stimulus Check Payment Date Is Next Week Ahead Of Final 300 Deadline The Us Sun

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Eps Powered By Pathward The Child Tax Credit Payments Pros And Cons To Think About

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Fourth Stimulus Check News Summary 20 November 2021 As Usa

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule